So many different pricing strategies…

Which one fits your business?

In recent decades, profits were optimized through several new pricing strategies.

I’ve worked out 17 different pricing strategies for you, let’s take a look:

What is a pricing strategy?

A pricing strategy is a strategy you use to set the price of your product or service where you try to maximize the profit relative to the value you provide.

The price of your product depends on many factors, including:

- Your target market and market demand

- How competitors price their products and services

- The frequency with which customers purchase

- The risk to the customer

The revenue model is a company’s strategy for making money from the value it delivers to the customer. The pricing strategy is the actual price the company charges the customer.

A good pricing strategy:

- Let the price be close to the value the customer receives.

- Convinces the customer to buy.

- Gives your customer confidence in the product or service.

Questions your customers answers for themselves while comparing:

- Who are the competitors to your product? What do they charge?

- Did the customer use a similar product before? What did they pay?

- What price ranges do they normally pay for a product or service like this? Are they price sensitive or value sensitive?

- What type of budget do they have for products like this?

17 different pricing strategies

I have worked out 17 different pricing strategies, it’s your turn to choose the best one:

1. Cost-plus pricing

The selling price is determined by taking the cost of a product or service and adding a percentage on top of that…

For this strategy, it is important to have a good understanding of the costs you have in providing your product or service so that you can be reliable in calculating your price.

See: Cost-plus pricing

Advantages

- Very simple and little risk of loss.

Disadvantages

- Does not take into account the price of competitors or the value customers give it.

Example

Let’s say you spend a total of €5,- to make a candle…

You take the €5,- and add a profit margin of 30%, your price per candle will be €6,50.

2. Value-based pricing

The price of a product or service is determined according to the perceived value of the product.

This pricing strategy is mainly used in markets where products are sold based on emotion, such as clothing.

See: Value-based pricing

Benefits

- The price you ask for has no limit.

- Shows that your customer is willing to pay a certain amount.

- You can focus more on the customer and the quality of your product.

Disadvantages

- Very dependent on marketing.

- Difficult to determine the price you ultimately charge.

- The value that the customer attaches to your product is often not stable.

Example

You buy an iPhone largely for the Apple brand and ease of use…It would be much cheaper to buy an Android phone, but you still pay extra for the iPhone.

3. Hourly pricing

You trade your time for money…

It says nothing about the value you deliver, but about the time you spend. Hourly pricing is widely used by consultants, freelancers, and people working under contract.

See: Hourly pricing

Benefits

- Very simple and there is hardly any risk.

Disadvantages

- In the short term, it does not take into account the value delivered. In the long run, the price probably won’t hold if you don’t deliver quality.

Example

A freelancer is hired for 200 hours at €30 per hour worked.

4. Performance-based pricing

The effectiveness of the product or service determines the price…

The risk to the seller is increased, but it does exude confidence toward the product or service.

The performance-based pricing strategy is often chosen when customers are afraid to overpay for something where they expect a certain result.

See: Performance-based pricing

Benefits

- Advantage over the competition because of the confidence you display.

- Opportunity for greater profits when results are good.

Disadvantages

- If results are poor, you get paid less.

Example

Suppose you hire a lawyer, you could give him some of the money you get for winning a case…

If the lawyer does not win the case, he also gets paid less.

5. Competition-based pricing

You base your price on the existing prices of the competition…

Companies in a highly competitive market could benefit greatly from this pricing strategy, as a small difference in price can make a big difference overall.

See: Competition-based pricing

Benefits

- It’s pretty easy to find out about competitors’ prices.

- And it’s hard to screw this up, because these prices work for your competition too.

Disadvantages

- You are dependent on the competition and can’t differentiate yourself on price in any case.

Example

If all the candles in the store are between €3 and €7 you can choose to offer your candle for €5.

6. Bundle pricing.

You bundle multiple products or services together for one price:

- Joint bundling: two products for one price.

- Leader bundling: discount on a leader product if a non-leader product is purchased with it.

- Mixed-leader bundling: the leader product can be purchased alone.

See: Bundle pricing

Benefits

- Maximize profits with up-sells and cross-sells.

- Get rid of products that normally don’t sell (less marketing).

Disadvantages

- With many different combinations, it can be relatively administrative.

- You need multiple products, which also relate to each other.

- Customers may want to buy one product rather than a bundle.

Example

Suppose you sell 3 different software packages…

You could sell them all separately, or you could sell all three at once.

7. Psychological pricing

You play on the psychology of man…

The price is aimed at a positive psychological effect.

Benefits

- Makes the product seem cheaper than it actually is.

- Makes the decision process easier for the customer.

Disadvantages

- It can create long term price expectations.

- Customers may feel manipulated.

Example

Pricing a product at €2.99 instead of €3 or choosing an odd price such as €23.47.

8. Geographical pricing

Adjusting the price to the location…

This is often done when customers are buying something across the border or when selling in a different geographical location.

See: Geographical pricing

Benefit

- Ensures that the difference of costs involved in selling in a different geographical location is covered.

Disadvantages

- Additional administration to keep track of location(s).

Example

If you order an item from the Netherlands on a French webshop you pay extra shipping costs, but also think of the McDonalds that might charge a bit more for the same burger in another location.

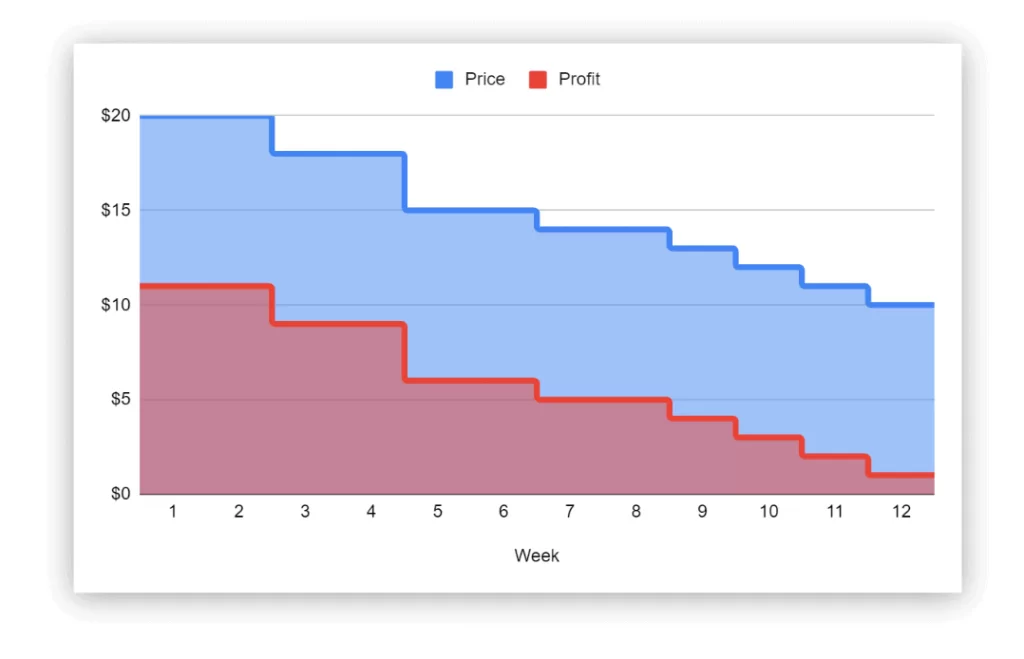

9. High-low pricing

Sell a product at a high price, but lower the price when relevance drops…

This strategy is also called the discount pricing strategy and is widely used by retailers who sell seasonally related items or items that change frequently.

See: High-low pricing

Benefits

- Adjusts the value of the price as the value of the product changes.

Disadvantages

- People may wait to buy because they want to wait for the “perfect” moment when the price/quality is best.

Example

The iPhone 11 initially cost $699 and was lowered to $599 after the release of the iPhone 12.

10. Penetration pricing

Entering the market with an extremely low price…

By offering a low price, a company can draw attention (and sales) away from other companies in the same market.

The Penetration Pricing strategy is not sustainable, at some point the company will have to raise its prices.

It is all about taking customers away from existing businesses and hoping that if you raise your price these customers will stay with you.

Penetration pricing is also called predatory pricing.

See: Penetration pricing

Benefits

- Provides extra motivation for customers to buy while it is still so cheap.

- Gives a lot of publicity and customers in a short time.

Disadvantages

- You make a loss at the beginning without certainty that you will break even at the end.

Example

Snack and drink producers often introduce new products at a low price so that people will try them…

After a while, they raise the price.

11. Premium pricing

Asking a high price to improve the perception of the product…

The premium pricing strategy is also called the image pricing or prestige pricing strategy.

It uses the principle that buyers often associate more expensive items with better items. You make the price higher than related products to make the buyer think your product is better.

See: Premium pricing

Benefits

- Higher profit margin and an edge over the competition.

- Better brand association.

Disadvantages

- It doesn’t work for all products and services.

- Lots of cost in marketing and improving the quality of your product.

Example

People often think that more expensive (branded) clothing often equals higher quality.

12. Project-based pricing

You set a price for an entire project…

This is the opposite of hourly pricing; the price you set is for the entire project and may depend on the added value of the project, the cost, or perhaps the number of hours that go into the project.

A project-based pricing strategy works best when the scope, specifications, and requirements are clear in advance.

Benefits

- Customer is certain that a completed project will be delivered for a fixed price.

Disadvantages

- If you make mistakes you will end up earning less, because the price has already been agreed on.

Example

Suppose an agency takes on a project to realize a website for €3,500, – then the agency promises to deliver the website according to the agreed requirements for €3,500, – within the agreed time.

13. Tiered-based pricing

You sell your products or services within a certain price range…

It may be that you divide the quantity of your products into price tiers or divide a number of features under certain price tiers:

See: Tiered pricing

Benefits

- There is always a suitable offer for the customer.

- The customer has more freedom of choice.

- Aiming your product or service at different target groups.

Disadvantages

- A lot of administration if you are going to change the tiers.

Example

From 0 – 10 products the price per product is €5 and from 10 – 100 products the price per product is €4.

14. Decoy pricing

You push the customer in a certain direction to choose by playing with price…

The decoy pricing strategy comes from the decoy effect and is also called the attraction of compromise effect.

You give the customer multiple choices and make one choice many times more attractive than the other choices.

See: Decoy pricing

Benefits

- If you do it right you can always get customers to buy the more expensive variety.

Disadvantages

- The customer may feel pushed too much in one direction.

- You always have one variation or product that is not bought.

Example

Suppose you sell coffee and cupcakes…

If you sell the coffee for €2 and a cupcake for €1.50 then about 70% will buy the coffee and 30% the cupcake.

If you add an option to buy a coffee with cupcake for €2.50 then about 90% will buy the coffee with cupcake.

15. Price discrimination

Prices differ based on what the seller thinks he will get for his product or service in different circumstances…

The seller places groups of customers into certain segments and tries to charge the maximum price for his product.

- First-degree price discrimination: different price for another new product being sold.

- Second-degree price discrimination: different price for a different quantity of goods purchased.

- Third-degree price discrimination: different price for a different group of customers.

See: Price discrimination

Benefits

- You can maximize profits.

Disadvantages

- Customers may feel they are not being treated fairly.

Example

Over-65s get a discount at some places.

16. Sliding scale

Price is based on what the customer has to spend…

Someone who has access to more resources pays more than someone who doesn’t have as many resources.

Benefits

- Shows empathy toward the customer.

- You can get customers you wouldn’t otherwise get.

Disadvantages

- It is impossible to maximize profit.

Example

At a networking event.

You may find that large companies pay more to ensure that small companies, who pay a smaller amount, can also participate.

17. Dynamic pricing

Price depends on demand or time…

Dynamic pricing is also called time-based pricing, demand pricing, or surge pricing and it ensures that the price is adjusted as demand increases or decreases or it is a certain time:

Many Internet companies apply this pricing strategy because it ensures that they can extremely optimize profits.

Through algorithms, factors such as:

- Time

- Demand

- Competition

Are taken into consideration to ultimately determine the extreme price someone is willing to pay.

See: Dynamic pricing

Benefits

- Maximizes profits tremendously.

- Can be used very scalably with internet companies.

Disadvantages

- Customers may feel disadvantaged.

- Often require fairly complex algorithms.

Example

Uber’s app charged a higher price for cabs at later times if your phone was running low.

8 laws of price sensitivity

There are 9 laws of price sensitivity, but I have explained the 8 most important ones for you:

- Reference price effect: if your product or service is more expensive than alternatives, the customer will think you offer more quality.

- Difficult comparison effect: price plays hardly any role if the customer has difficulty comparing it with alternatives.

- Switching costs effect: if the customer incurs costs when switching suppliers, it becomes less sensitive to price.

- Price-quality effect: if it is known that a higher price offers more quality customers give a lower rating to the price.

- Expenditure effect: customers become very sensitive to price if the purchase price is a large percentage of their budget.

- Shared-cost effect: the smaller the proportion that customers have to pay for themselves, the less price-sensitive they become.

- Fairness effect: customers become more price-sensitive if they think the price is unfair.

- The framing effect: customers are more price sensitive if they perceive the price as a loss rather than as something they can gain. In addition, they will be more price-sensitive to buying single items rather than a bundle.

Price elasticity of demand

To determine how strong the relationship between price and demand is you can use the following formula:

% change in quantity / % change in price = price elasticity of demand.

If the price of cigarettes and fuel gets higher then consumers just keep buying, this is because this product is seen as ‘inelastic’. On the other hand, if the price of movie tickets or cable TV increases then there will be less demand.

How do you choose a pricing strategy?

Hoe kies je een prijsstrategie?

- Investigate which factors determine your price

Look at what factors the purchase of your product or service depends on. Perhaps the mapping of the Decision Making Unit is useful here.

- See what kind of pricing strategy your competitors use

How do your competitors determine the price? Here you can often learn a lot.

- Check how you optimize profits

If you know what factors your price depends on and how your competitors determine the price, you can start to investigate how you optimize your price for profit and what pricing strategy you apply.

Possibly you could try Hotjar’s Van Westendorp price sensitivity survey, with the questions:

- At what price would this product be so expensive that you wouldn’t even think of buying it?

- At what price would this product be so cheap that you would doubt the quality of the product?

By eventually plotting the answers you will get something like the graph below:

In addition, it is important to look at when you maximize profit rather than when you maximize Customer Acquisition Cost because what matters is what is ultimately left at the bottom of the line.

That’s it…

What are you going to do?

So, now you know what pricing strategies are out there…

I want to know from you, which pricing strategy do you apply and why?

Let me know in a comment below.

P.S. if you would like additional help let me know at [email protected]

Frequently asked questions

Pricing strategy is a strategy you use to price your product or service where you try to maximize the profit relative to the value you provide.

There are many different pricing strategies, but there are up to 15 that are used very often. Consider the cost-plus pricing strategy, value-based pricing strategy, performance-based pricing strategy, or the competition-based pricing strategy.

The revenue model is about the strategy the company chooses to make money from the value it delivers to the customer and the pricing strategy reflects how the revenue model price is determined.

It very much depends on your product, business model, and customer which pricing strategy is best to use. Send me a message at [email protected] to look at it together.

Online you can ideally optimize prices for maximum profit. You do this by developing algorithms that take into account factors such as demand, time, and competition in determining the ideal price.

![Business-Driven Marketing (BDM): 8 Steps to Drive Business Impact [+14 Templates]](https://gustdebacker.com/wp-content/uploads/2024/07/Business-Driven-Marketing-BDM.png)

![Automate ~30% of Repetitive Marketing Tasks with AI: 5 Easy Steps [+ 7 Expert Prompts]](https://gustdebacker.com/wp-content/uploads/2024/07/AI-in-Marketing.png)

![Customer Journey Map (2025): How-to & Examples [+ Template]](https://gustdebacker.com/wp-content/uploads/2023/11/Customer-Journey-Map.png)

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.